On October 10, the Department of Justice, Financial Crimes Enforcement Network (FinCEN), Federal Reserve, and Office of the Comptroller of Currency imposed over $3 billion in penalties on TD Bank. TD Bank pled guilty to violating the Bank Secrecy Act and conspiring to commit money laundering. The case is history-marking for two reasons. First, the fine is the largest U.S. authorities have ever imposed for anti-money-laundering failures at a financial institution. Second, no U.S. bank has ever before pled guilty to conspiracy to commit money-laundering. In addition to the huge cash penalty, TD Bank also faces one of the strictest punishments in the Office of the Comptroller of Currency’s arsenal: an asset cap so the bank can’t grow its business.

TD Bank’s conduct was eye-poppingly bad. As Merrick Garland put it, “By making its services convenient for criminals, TD Bank became one.” The bank failed to screen 92% of its transactions for money laundering risk between 2018 and 2024, leaving about $18.3 trillion in transactions unmonitored. That included all domestic automatic clearinghouse (ACH) activity, most transactions by check, and internal transfers between TD Bank accounts. Three separate money-laundering operations moved over $670 million through TD Bank accounts between 2019 and 2023. Five TD Bank employees accepted bribes from a money-laundering organization and then proceeded to open and service its accounts, issue dozens of debit cards, and ultimately allow the organization to launder $39 million to Colombia.

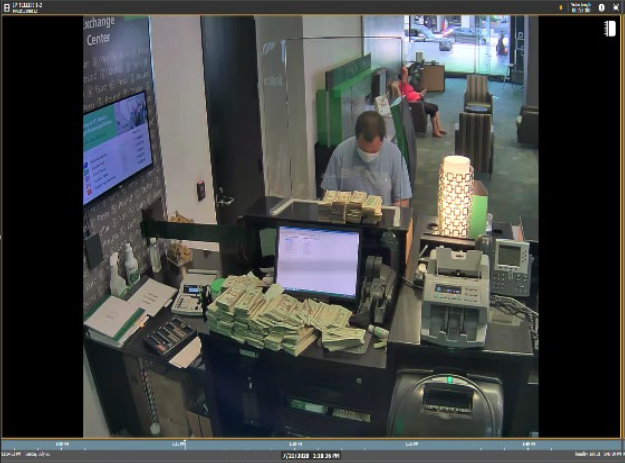

Also, this happened:

Photo credit: TD Bank security camera via United States v. TD Bank US Holding Company Plea Agreement

The image shows Da Ying Sze (whom TD Bank employees knew as “David”) conducting a $372,000 cash transaction in an account that was not in his name. Bank tellers were supposed to file “Unusual Transaction Referrals” for potentially suspicious conduct, but no one filed a report for this transaction. That may be because David gave TD Bank employees more than $57,000 in retail gift cards. He later pled guilty to money laundering and noted that TD Bank was the most convenient bank for him to use to clean money.

All this took place despite TD Bank having a compliance operation that looked reasonable on paper. Behind the scenes, though, it had gutted its compliance department to keep costs down. The bank knew it needed to beef up its compliance monitoring, but repeatedly vetoed new initiatives and new hiring as “too costly.” From 2014 to 2022, the compliance department’s AML program remained almost unchanged, while the bank’s business rapidly evolved. For instance, during that period, TD Bank added Zelle as a cash-transfer service for its customers and did not institute sufficient oversight for it.

TD Bank’s compliance employees knew their systems were inadequate. Here’s a conversation between two Anti-Money Laundering (AML) workers at TD Bank that’s quoted in the plea agreement:

Here’s another:

If you are a compliance employee at a financial institution and you find yourself having conversations like this, please consider blowing the whistle instead of “loling” privately. As Deputy Secretary of the Treasury Wally Adeyemo explained, “From fentanyl and narcotics trafficking, to terrorist financing and human trafficking, TD Bank’s chronic failures provided fertile ground for a host of illicit activity to penetrate our financial system.” FinCEN now has a whistleblower program for violations of the Bank Secrecy Act, which includes anti-money laundering failures. If Congress had created that program earlier, perhaps TD Bank’s misconduct could have been stopped years ago.